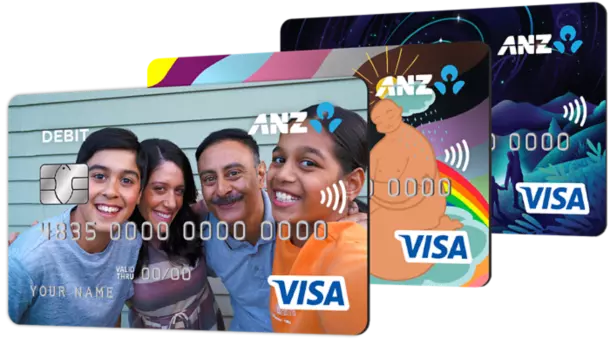

As a leading financial institution in Australia and New Zealand, ANZ offers a diverse range of ANZ Credit Cards to cater to the diverse needs of its customers. Whether you’re looking for low interest rates, rewarding loyalty programs, or flexible credit limits, ANZ has the perfect credit card solution to empower your financial journey.

ANZ Credit Cards provide customers with low interest rates, enabling seamless spending and financial flexibility. The bank’s rewards programs are tailored to customers’ lifestyles, allowing them to earn points on eligible purchases that can be redeemed for a variety of rewards.

In addition to low interest rates and rewarding loyalty programs, ANZ Credit Cards also offer competitive annual fees and flexible credit limits to suit individual financial requirements. The application process is straightforward, with customers able to easily check their eligibility.

Customers have consistently praised the features and benefits of ANZ Credit Cards, as well as the high level of customer service provided by the bank. With ANZ, you can unlock a world of financial possibilities and embark on your personal financial adventures with confidence.

Unlock Financial Freedom with ANZ Credit Cards

When it comes to managing your finances, low interest rates can make all the difference. Fortunately, ANZ Credit Cards offer customers in Australia and New Zealand the perfect solution, with competitive low interest rates that enable seamless spending and financial flexibility. Whether you’re making everyday purchases or planning a big-ticket item, the ANZ Credit Cards ensure you can do so without the burden of high-interest debt.

Low Interest Rates for Seamless Spending

The low interest rates on ANZ Credit Cards allow customers to make purchases with confidence, knowing they won’t be faced with exorbitant interest charges. This empowers you to manage your finances effortlessly, focusing on your financial goals rather than worrying about the cost of credit.

Rewarding Loyalty Programs Tailored to Your Lifestyle

In addition to the competitive low interest rates, ANZ Credit Cards offer rewarding loyalty programs that are tailored to your unique lifestyle. Whether you’re a frequent traveler, an avid shopper, or simply looking to earn points on your everyday expenses, ANZ’s rewards programs provide a variety of options for earning and redeeming points on eligible purchases.

ANZ’s transparency around annual fees and credit limits further enables customers to make informed decisions that align with their budgets and financial goals. The bank’s commitment to providing exceptional customer service has also been praised by clients, who have expressed satisfaction with the overall experience of using ANZ Credit Cards.

ANZ Credit Cards: Flexible Options for Every Need

When it comes to ANZ Credit Cards, customers in Australia and New Zealand can enjoy a diverse range of options tailored to their unique financial requirements. Whether you’re seeking a card with low interest rates, a rewards program that aligns with your lifestyle, or a flexible credit limit, ANZ has a solution to meet your needs.

The application process for ANZ Credit Cards is designed to be straightforward and efficient, allowing you to easily check your eligibility criteria and apply through various channels, including online or in-person at an ANZ branch. The bank provides clear and transparent information about the eligibility requirements for its credit card products, empowering you to make informed decisions about the best card for your financial situation and goals.

Customers have consistently praised the exceptional customer service provided by ANZ, with the bank’s staff going above and beyond to assist you in finding the right credit card option to suit your needs. Whether you’re looking to manage your finances with low interest rates or earn rewards on your everyday purchases, ANZ has the flexible solutions to empower your financial journey.

Simplifying Money Management: ANZ’s Innovative Features

In addition to its range of ANZ Credit Cards, ANZ offers innovative features that simplify money management for its customers.

Mobile Banking: Convenience at Your Fingertips

ANZ’s mobile banking app provides ANZ Credit Card customers with seamless access to their accounts and cards, allowing them to manage their finances on-the-go. With features like real-time account balances, transaction monitoring, and the ability to make payments, the app offers unparalleled convenience and flexibility for busy customers.

Fraud Protection: Safeguarding Your Finances

ANZ Credit Cards come equipped with comprehensive fraud protection measures, including advanced security features and 24/7 monitoring, to safeguard customers’ financial information and transactions.

Customers have consistently praised the exceptional customer service provided by ANZ, with the bank’s staff going above and beyond to assist customers with any issues or queries they may have, whether related to their credit cards or other banking needs. This high level of customer support has contributed to a positive overall experience for ANZ’s customers, many of whom have expressed satisfaction with the bank’s innovative features and services.

| Feature | Description |

|---|---|

| Mobile Banking App | Convenient access to accounts and ANZ Credit Cards, with features like real-time balances, transaction monitoring, and payment capabilities. |

| Fraud Protection | Advanced security features and 24/7 monitoring to safeguard customers’ financial information and transactions. |

| Customer Service | Exceptional support from ANZ staff, going above and beyond to assist customers with any issues or queries. |

Empowering Communities: ANZ’s Commitment to Financial Wellbeing

At the forefront of this effort is ANZ’s flagship financial education program, MoneyMinded, which has reached over 927,500 participants since its inception in 2002.

MoneyMinded has been instrumental in building the financial knowledge, confidence, and skills of individuals across Australia, New Zealand, Asia, and the Pacific. Through this program, Bank provides free training and resources for community professionals, financial counsellors, and other partners, equipping them with the tools to deliver essential financial education workshops and support to their clients and communities.

By spearheading initiatives like MoneyMinded, Bank has demonstrated its unwavering dedication to shaping a world where people and communities can thrive. The bank’s holistic approach to financial wellbeing empowers individuals with the knowledge and resources they need to make informed financial decisions, ultimately fostering greater financial resilience within the communities it serves.

Frequently Asked Questions

What features and benefits do ANZ Credit Cards offer?

Bank Credit Cards provide customers with low interest rates, enabling seamless spending and financial flexibility. ANZ Credit Cards also offer competitive annual fees and flexible credit limits to suit individual financial requirements.

How do I apply for an ANZ Credit Card?

The application process for Bank Credit Cards is straightforward, with customers able to easily check their eligibility. ANZ provides clear and transparent information about the eligibility criteria for its credit card products, ensuring customers can make informed decisions about which card best suits their financial situation and goals.

What do customers say about ANZ Credit Cards?

Bank Credit Card customers have praised the cards’ features and benefits, as well as the high level of customer service provided by the bank. Customers have consistently praised the exceptional customer service and support offered by ANZ, with the bank’s staff going above and beyond to assist customers in finding the right credit card solution for their needs.

What innovative features do ANZ Credit Cards offer?

ANZ’s mobile banking app provides customers with convenient access to their accounts and credit cards, allowing them to manage their finances on-the-go. bank Credit Cards also come with robust fraud protection measures, including advanced security features and 24/7 monitoring, to safeguard customers’ financial information and transactions.

How is ANZ committed to empowering communities and promoting financial wellbeing?

Through initiatives like the MoneyMinded financial education program, bank has demonstrated its commitment to shaping a world where people and communities can thrive, by equipping individuals with the tools and knowledge they need to make informed financial decisions and achieve greater financial resilience.

For more informations: https://www.anz.com.au/personal/credit-cards/