Welcome to the world of ANZ Bank Credit Cards, where financial freedom meets flexibility. Whether you’re looking to manage your everyday expenses or earn rewards while you spend, ANZ offers a range of credit card options tailored just for you. Navigating through credit can be daunting at times, but understanding how these cards work will empower you in mastering your finances. Let’s dive into everything ANZ Bank has to offer and help you choose the perfect card that fits your lifestyle and goals!

Types of Credit Cards Offered by ANZ Bank

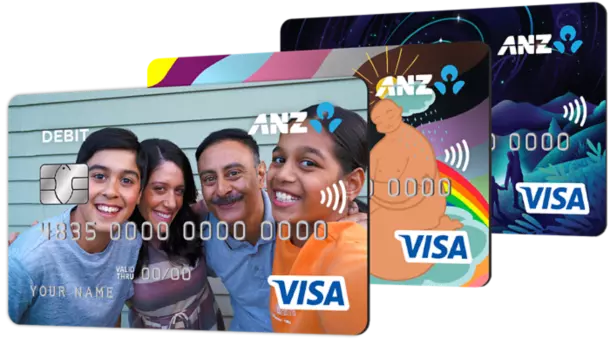

ANZ Bank offers a diverse range of credit cards to suit various needs and lifestyles. Each card comes with its unique features, allowing you to choose one that aligns perfectly with your financial goals.

The ANZ Rewards Credit Card is popular among those who love earning points on purchases. Whether you’re shopping for groceries or dining out, every dollar spent brings you closer to exciting rewards.

For frequent travelers, the ANZ Travel Adventures Card provides excellent benefits such as travel insurance and no foreign transaction fees. This card can enhance your travel experience while offering valuable extras.

If you’re focused on keeping interest rates low, the ANZ Low Rate Credit Card might be ideal for you. It combines essential features with a competitive rate, helping manage costs effectively.

With these options and more, there’s an ANZ credit card tailored for virtually everyone’s preferences and requirements.

Benefits and Rewards of ANZ Credit Cards

ANZ Credit Cards come packed with a variety of benefits that can enhance your financial experience. One major highlight is the rewards program, which allows you to earn points for every dollar spent. These points can be redeemed for travel, merchandise, or even cashback.

Additionally, many ANZ cards offer complimentary insurance coverage. This includes travel insurance and purchase protection, bringing peace of mind when making large purchases or planning trips abroad.

Cardholders often enjoy exclusive access to events and promotions. Whether it’s presale tickets for concerts or special dining experiences, there are perks beyond everyday transactions.

Another advantage is their flexible payment options which help manage expenses more effectively. You have the choice between interest-free days and manageable repayment plans tailored to fit your lifestyle needs.

Don’t forget about competitive introductory offers too! They frequently feature low-interest rates or bonus point incentives designed to attract new customers.

How to Apply for an ANZ Credit Card

Applying for an ANZ Credit Card is a straightforward process. Start by visiting the ANZ website to explore the various credit card options available.

Once you’ve chosen a card that suits your needs, gather necessary documents. This typically includes proof of identity, income statements, and details about your financial situation.

Next, fill out the online application form. Ensure all information is accurate to avoid delays. The form will ask for personal details and employment history.

After submitting your application, you might receive instant feedback on approval. If further verification is needed, ANZ will contact you within a few days.

If approved, you’ll receive your new credit card in the mail along with its terms and conditions for use.

Tips for Managing Your ANZ Credit Card

Managing your ANZ Credit Card effectively can enhance your financial health. Start by setting a budget that includes your credit card spending. This will help prevent overspending and keep your finances in check.

Make it a habit to pay off the balance in full each month. This practice avoids interest charges and improves your credit score over time.

Utilize the online banking features provided by ANZ for easy tracking of transactions. It allows you to monitor expenses, set alerts, and manage payments effortlessly.

Consider taking advantage of any rewards or cashback programs associated with your card. These perks can add significant value to everyday purchases.

Always stay informed about any changes in terms and conditions related to fees or benefits. Being proactive ensures that you make the most out of your ANZ Credit Card.

Alternatives to ANZ Credit Cards

If ANZ Bank credit cards don’t quite fit your needs, there are several alternatives worth exploring. Many banks and financial institutions offer competitive options with varied benefits.

Common alternatives include Westpac, which provides a range of rewards programs tailored to everyday spending. Their cash-back offers can be appealing for those who want instant savings.

NAB also stands out with its low-interest rate cards. This option is great for users looking to carry a balance without incurring hefty fees over time.

Another solid choice is Commonwealth Bank, known for its user-friendly app that helps you keep track of expenses effortlessly.

Consider online-only providers like 86400 or Up Bank. They often feature minimal fees and attractive rates aimed at tech-savvy consumers who prefer managing finances through mobile platforms. Exploring these options can lead you to the right card for your lifestyle and financial goals.

Frequently Asked Questions

When exploring ANZ Bank Credit Cards, many queries arise. Here are some of the most frequently asked questions to help clarify any uncertainties you might have.

What types of credit cards does ANZ offer?

ANZ provides a variety of credit card options tailored to different customer needs. Whether you’re looking for low-interest rates, rewards programs, or travel perks, there’s likely an option suited just for you.

Are there annual fees associated with ANZ credit cards?

Yes, most ANZ credit cards come with an annual fee. However, this fee varies depending on the type of card and its features. Be sure to review these details when choosing your card.

How can I check my application status?

You can easily track your application status online through the ANZ website or by calling their customer service line. Having your reference number handy will streamline the process.

Can I transfer my existing balance from another bank?

Absolutely! Many ANZ credit cards allow balance transfers from other banks at promotional interest rates for a limited time. This feature is helpful if you’re managing multiple debts.

What should I do if I encounter issues using my card?

If you experience problems while using your ANZ credit card—such as declined transactions or technical difficulties—contact their support team immediately for assistance.

Understanding these aspects can empower you in making informed financial decisions regarding your choices and management practices with ANZ Bank Credit Cards.

For more information: Credit Cards